If you are thinking of buying a property with the intention of holiday letting then there are a number of financial considerations you need to take into consideration.

Stamp duty is one of those things that can catch buyers unaware, so its important you have all the facts and figures before going ahead.

What is Stamp Duty?

One of these is Stamp Duty (Land Transaction Tax) – in Wales. According to the Welsh Government “You must pay LTT if you buy a property or land over a certain price in Wales. The current LTT threshold is £225,000 for residential properties purchased at the main rates and £225,000 for non-residential land and properties”.

How Does It Work?

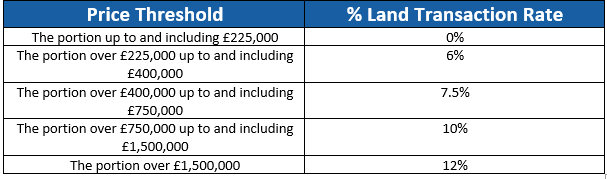

You are taxed on the part of the property that falls into each Stamp Duty threshold (pictured below).

For example, if you buy a property in Wales for residential use only for £470,000

You will pay 0% on anything up to £220,000, you will then pay 6% on the next £175,000 and 7.5% on the final £70,000.

That equals £0 (0% of £225,000) + £10,500 (6% of £150,000) +£5,250 (7.5% of £70,000) = £15,750

There are also some helpful calculators online that can calculate this for you depending on the reason for purchasing

What Are the Price Bands?

Shown below are the price bands for stamp duty in Wales.

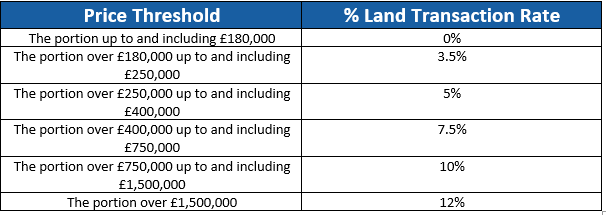

If purchasing a second home with the intent of letting such as holiday letting, there is an additional premium charge

What Is the Additional Premium?

There is a premium to pay on top of this in Wales in certain circumstances

If purchasing a second residential property in Wales, there is an additional premium charge.

The premium for second properties in Wales is 4%. This is on top of the standard LTT payable (as above).

So taking the example we gave above, if this purchase was a second residential purchase, you would need to pay additional land transaction tax of £18,800.

Who Has to Pay the Higher Rates of Stamp Duty (Land Transaction Tax)?

If you’re buying an additional residential property, you’ll probably have to pay the higher rates of Stamp Duty.

These are the rules that apply:

- if the residential property you’re buying is worth £40,000 or more and you already own a property worth £40,000 or more.

- additional properties that you part own, so long as your share is worth £40,000 or more.

- if you currently own a property abroad and are looking to buy an additional property back in the UK worth more than £40,000.

- when you’re married or in a civil partnership, the rules apply as if you’re buying the property together, even if you’re not. So, if your spouse has to pay the higher rates, you’ll have to pay them.

- if you purchase a property with someone else, if they apply individually, they will apply as a whole.

Are There Any Exemptions to Paying the Higher Rates?

There are some cases where you could be exempt from the higher rates of Stamp Duty as well as any stamp duty at all.

According to the Welsh Government these include:

- no money or other payment changes hands for a land or property transfer

- property is left to you in a will

- there is a transfer of property due to the dissolution of a civil partnership or divorce

- you buy a freehold property for less than £40,000

- buying a new or assigned lease of 7 years or more, as long as the premium is less than £40,000 and the annual rent is less than £1,000

- buying a new or assigned lease of less than 7 years, as long as the amount you pay is less than the residential or non-residential SDLT threshold

- you use alternative property financial arrangements, for example to comply with Sharia law

Other reasons you wont need to pay the additional rate include:

- you use your new property as your main home and have sold the last main home you owned before you buy your new home (or on the same day)

- if the property is worth less than £40,000.

- if you buy a property for less than £225,000 and you do not own any other property

- A mixture of residential and non-residential space (like a shop with a flat above it)

- if the property is moveable – e.g. caravans, houseboats or mobile homes

- if it is freehold property with a lease on it which has more than 21 years left to run, held by someone unconnected to you

- The property has restrictions that only allow it to be let as holiday accommodation

- The property was uninhabitable when purchased

For more advice on exemptions we advise speaking to a qualified financial advisor such as our partners Zeal Tax, You can call them on 01633 499771 or email them at Sykes@gozeal.co.uk.

Can I Offset the Cost of Stamp Duty?

The good news is if you are considering purchasing a holiday let, there are many tax advantages and benefits you may be eligible for which will help offset some of your losses.

Read about the tax advantages of holiday letting in our Furnished Holiday Lettings Tax Guide.

Additional resources

Welsh Government

HMRC

Zoopla

* At the time of publishing (10/10/2022), Menai Holidays has taken all reasonable care to ensure that the information contained in this article is accurate. However, no warranty or representation is given that the information is complete or free from errors or inaccuracies. Generic information is contained within this article and each individual’s financial affairs are different, further advice should be sought from a financial advisor.

Please Note: The information contained in this article was accurate at the time of writing, based on our research. Rules, criteria and regulations change all the time, so please contact our prospective new owner team if you’d like to hear how. Nothing in this article constitutes the giving of financial, tax or legal advice to you; please consult your own professional advisor (accountant, lawyer etc). in this regard. If we have referred within the article to a third-party provider of unregulated holiday let mortgages, this is due to the fact that such mortgages aren’t currently regulated by the FCA.

As a helpful reminder, your home may be repossessed if you do not keep up repayments on a mortgage, so again anything you decide to do in this particular area this is one on which you should take your own professional advice on too, as we aren’t providing and can’t provide you with this.